How can a pension plan help you secure your retirement?

AN OPTION TO START BUILDING WEALTH FOR YOUR FUTURE RIGHT NOW!

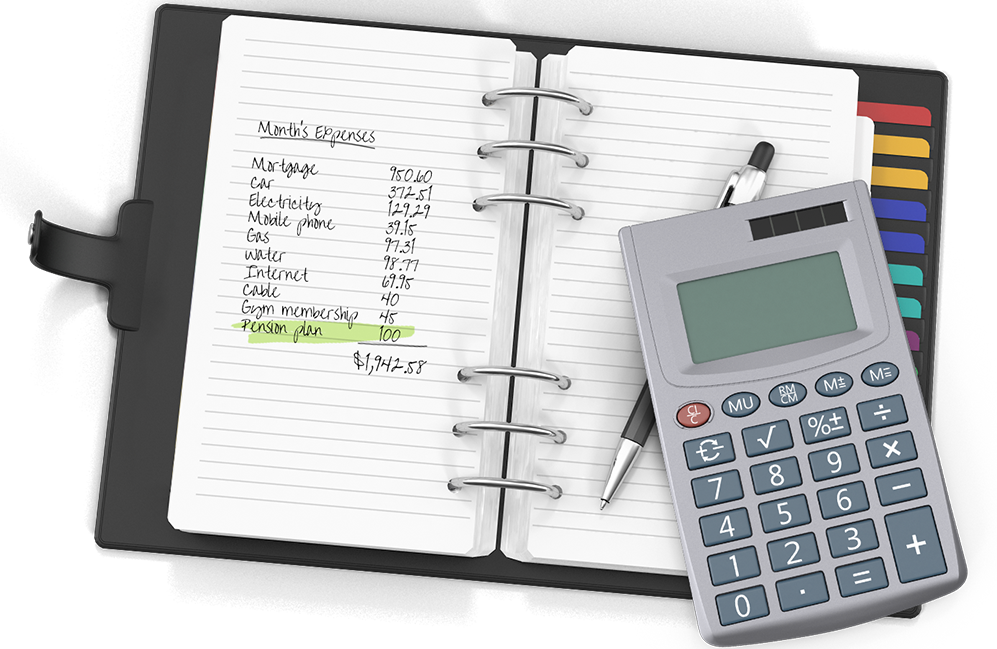

WEALTH CALCULATOR

CALCULATE YOUR SPP WEALTH GROWTH IN SECONDS

Use our Wealth Calculator to get an idea of how much you could potentially save for your retirement if you started now.

PERSONAL PLANS

Think you’re too old – or too young – to have a pension plan? Or perhaps don’t have enough to contribute? SPP is a personal retirement plan for that is flexible enough to suit many situations.

Learn MoreBUSINESS PLANS

Finally, a pension plan solution designed for businesses, large and small. SPP provides a simple, flexible solution that can reward loyal employees and attract new ones. Learn more about the long list of benefits SPP offers your business.

Learn More

COLLECTING YOUR

SPP PENSION IS EASY

Once you turn 55, you have the option to collect your Saskatchewan Pension Plan benefits – whether you’re ready to retire or not. And we’re here to educate you on your SPP pension collection options.

Learn More