Popular Questions

Where can I learn more about the variable benefit (VB)?

Members looking at the VB for a retirement option can review our guide here.

Does SPP offer online access to member accounts?

Yes, MySPP is a portal which allows contributing members and members who are receiving a pension payment from us to access their account online.

Members are able to view their contact, beneficiary, power of attorney information, account balance or pension payment information, tax receipts, T4A or NR4 forms and member statements. We will post updates when these documents are available on the announcement page as members logon to MySPP.

You can check out this quick video on how to enroll for MySPP.

What is the Plan's rate of return?

The Saskatchewan Pension Plan's average return to members since inception (1986) for the Balanced Fund (BF) is 7.8%. The five-year average is 6.75% and the ten-year average is 6.75%. Past returns do not guarantee future results - View all Fund & Performance Info.

What is the difference between SPP and an RRSP?

SPP follows the same income tax deferral rules as an RRSP, but SPP is locked-in until age 55. Once you start collecting SPP annuities they are eligible for the Pension Income Tax Credit (you may be able to claim up to $2,000).

You record your SPP contribution tax receipts the same way you would record a regular RRSP contribution tax receipt. Under tax rules contributions to SPP can be used as repayments to the Home Buyers Plan (HBP) and the Lifelong Learning Plan (LLP) - However, withdrawals are not permitted for this purpose.

Can I take my money out of SPP?

SPP is a locked-in pension plan which means your contributions must stay with the Plan until you are at least 55 years old. In the event of your death, the money in your account will be paid to your beneficiary.

Members may receive a refund of their account if they change their mind within 60 days of their date of application or their first contribution, whichever is later.

How much can I contribute to SPP?

SPP regulations have been amended to remove the limits. Members can now contribute within their RRSP contribution room. There are no yearly minimums, and no obligation to contribute on a set schedule. In addition, you can Transfer-In from existing unlocked RRSPs, RRIFs, RPPs, and DPSPs.

Beneficiaries

What happens to my money when I die?

If you die before you begin receiving payments from SPP, the funds in your account are paid in a lump sum to whomever you have named as beneficiary. If you die after you retire, the death benefits are paid out according to the pension option selected.

If you name your spouse as beneficiary of your account, Canada Revenue Agency (CRA) allows death benefits to be transferred, tax-deferred, directly to his or her SPP account or to an RRSP, RRIF or guaranteed Life Annuity. Tax-deferred transfer options are also available if the beneficiary is a financially dependent child or grandchild. Please contact SPP or CRA for further information.

Can I change my Beneficiary?

Contributors to SPP may change their beneficiary at any time by notifying the Plan in writing. If you retire under the Refund Life Annuity, you may also change the beneficiary at any time. Visit Member Services to download a Change of Beneficiary Form

Check out these quick video about Beneficiaries changes for contributing members and Beneficiaries changes for retired members.

Contributions

Can I take my money out of SPP?

SPP is a locked-in pension plan which means your contributions must stay with the Plan until you are at least 55 years old. In the event of your death, the money in your account will be paid to your beneficiary.

Members may receive a refund of their account if they change their mind within 60 days of their date of application or their first contribution, whichever is later.

How much can I contribute to SPP?

SPP regulations have been amended to remove the limits. Members can now contribute within their RRSP contribution room. There are no yearly minimums, and no obligation to contribute on a set schedule. In addition, you can Transfer-In from existing unlocked RRSPs, RRIFs, RPPs, and DPSPs.

Do I have to contribute the same amount each year?

There is no minimum contribution. SPP is designed to be very flexible and to accommodate your individual financial circumstances. How often you contribute is entirely up to you.

How do I make my contribution?

Contributions can be made in a number of ways: through online banking; directly from your bank account using the PAC system on the 1st or 15th of the month; at your financial institution using a contribution form; mailing it to the SPP office in Kindersley; or using your VISA or MasterCard online.

Is my spouse able to make contributions on my behalf?

Spousal contributions are permitted. Contributions you make to a spouse or common-law partner's account reduce your RRSP deduction limit. The total amount you can contribute for a given tax year cannot be more than your RRSP contribution limit.

Contribution and PAC forms have a section to designate contributions for spousal deduction. Visit Member Services to find the appropriate Account Forms.

Check out this quick video about Spousal contributions to SPP.

How much of my contribution can I claim as a yearly RRSP tax deduction?

Contributions made to SPP follow the RRSP contribution year and tax deadlines:

- Contribution year begins the 61st day of the year, and lasts 10 months of the tax year (March to December)

- You will typically see March 2 to December 31 referred to as the “remainder of the year” in terms of tax receipts for a given year;

- Contribution year ends the 60th day of the following year;

- You will typically see January 1 to March 1 of the following year referred to as the “first 60 days” tax receipt for the prior tax year;

Example of prior contribution years:

Tax Year

remainder of the year tax receipt

first 60 days tax receipt

2025

March 4, 2025 - December 31, 2025

January 1, 2026 - March 2, 2026

2026

March 3, 2026 - December 31, 2026

January 1, 2027 - March 1, 2027

Check out this quick video about Why is your Notice of Assessment important?

What are the implications of contributing to SPP if you live outside of Canada?

Even if you are a non-resident of Canada, you may be eligible to contribute to SPP as long as you still have RRSP contribution room. The issue is if you are no longer filing income tax returns in Canada, you won't be able to receive the tax deduction and resulting tax benefit from these contributions. However, the contributions would allow your pension account to grow as a tax sheltered savings tool for retirement.

When it comes time to retire from SPP the pension income is taxable and will be subject to non-resident withholding taxes. These differ depending on your country of residence. Either way, as a non-resident, you are still able to receive your SPP pension income.

Fund & Performance Info

Looking for information about investment term?

Check out our investment terms playlist.

What is the Plan's rate of return?

The Saskatchewan Pension Plan's average return to members since inception (1986) for the Balanced Fund (BF) is 7.8%. The five-year average is 6.75% and the ten-year average is 6.75%. Past returns do not guarantee future results - View all Fund & Performance Info.

Who will invest my money?

SPP has independent, professional money managers. The funds are invested in a diversified portfolio of high-quality investments to ensure a competitive rate of return. Your investments are monitored regularly.

Leith Wheeler Investment Counsel Inc., TD Asset Management, Fengate Capital Management Ltd. and Ninepoint Partners LP are the Plan's investment managers.

Are there Fund Facts available?

Yes, we have Fund Facts for Balanced Fund (BF) and Diversified Income Fund (DIF). Fund Facts are easy-to-read documents designed to help you better understand the basic features of our funds and compare their differences.

Diversified Income Fund (DIF) Facts

Check out this quick video about SPP portfolio and Fund Fact.

Pension Payments

When is the SPP pension paid?

Your pension is paid on the first day of the month. If the first day falls on a weekend or holiday, it will paid on the last business day of the previous month.

Looking for more information about SPP retirement?

Check out our retirement playlist.

Do I have to wait until I retire to start collecting pension payments?

No. You can start collecting an SPP pension anytime between the ages of 55 and 71 regardless if you're retired from working. Once you start collecting pension payments you can no longer make contributions to SPP – Learn more about collecting pension payments.

Can I get my money out in a lump sum?

After the age of 55, if you have a pension benefit of $28.54 or less per month, you may choose to take your money out in cash less a 10% withholding tax (sent to Canada Revenue Agency) or transfer your account into an RRSP.

Can I transfer my pension out?

Between the ages of 55 and 71, one of the options available is to transfer to either a Prescribed Registered Retirement Income Fund (PRRIF) or a Locked-in Retirement account (LIRA) with another financial institution. Visit How to Collect for more information.

Will my monthly pension ever change?

No. Every month we set the earnings and annuity rates according to current markets. The month you retire determines your monthly benefit for the rest of your life.

Will my SPP annuity income qualify for the Pension Income Tax Credit?

Yes, your SPP annuity payment qualifies for the Pension Income Tax Credit.

Variable benefit

Where can I learn more about the variable benefit (VB)?

Members looking at the VB for a retirement option can review our guide here.

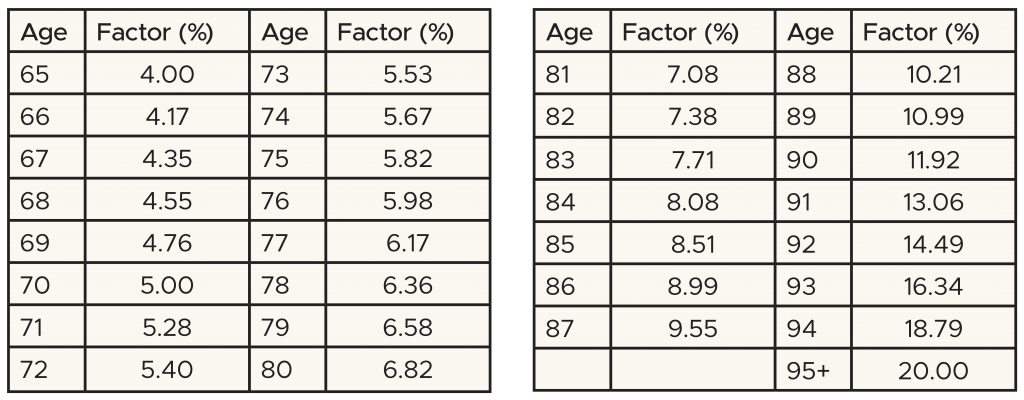

What are the minimum withdrawal amounts?

Required minimum withdrawals (based on the Income Tax Regulations (Canada)) must begin the calendar year the member reaches age 72. Prescribed factors are listed below.

When is SPP Variable Benefit paid?

Your Variable Benefits payment is made by the twentieth day of the month.

How is a VB different from a pRRIF and an RRSP?

A VB allows payments to be made directly from a pension plan account rather than needing to be transferred to another financial institution (pRRIF) for this purpose.

A VB means your retirement savings have been converted to income rather than being in the saving stage as in the case with an RRSP.

How are my funds invested?

You can decide how your VB account is invested in SPP’s options. SPP has two investment options: BF invests in a mix of global equities, real estate, infrastructure, fixed income and cash equivalents; and DIF invests in short-term Canadian debt securities, bonds and mortgages.

Who is the VB available to?

All SPP members, between the ages of 55 and 71, and whose account balance exceeds the small pension amount.

What happens when my funds are gone?

When your VB account is depleted to $0 payments stop.

MySPP Account

Does SPP offer online access to member accounts?

Yes, MySPP is a portal which allows contributing members and members who are receiving a pension payment from us to access their account online.

Members are able to view their contact, beneficiary, power of attorney information, account balance or pension payment information, tax receipts, T4A or NR4 forms and member statements. We will post updates when these documents are available on the announcement page as members logon to MySPP.

You can check out this quick video on how to enroll for MySPP.

What should I expect while using MySPP?

MySPP is a secure tool allowing members to access information about their account; contributions and address changes may not be reflected immediately. If you have submitted a change of account information or a contribution please allow up to five business days for our staff to apply the information to your account.

We intend that MySPP will be available 24 hours day; however we may have to perform maintenance on our servers which may require minimal scheduled outages.

You can check out this quick video about what you will find on MySPP.

MyBusiness Portal

Does SPP offer online access to business plans?

Yes, MyBusiness is a portal which allows businesses members to administer their SPP business plan online at any time of day.

Businesses are able to update their current employees, change the administrators of their plan, set payment methods to remit contributions for their employees. You will also have access to documents related to past remittances.

What should I expect when using MyBusiness?

MyBusiness is a secure tool allowing businesses to have a self-service portal for employers to set up their SPP account, manage employees on the Plan, make payments and access documents related to your business plan.

We intend that MyBusiness will be available 24 hours day; however we may have to perform maintenance on our servers which may require minimal scheduled outages.

How do I set up a MyBusiness account?

For new business, you can go to the Register New Employer link. You will complete a one-time registration process begins with the login screen, initial information inputs, email validation, and progresses through a three-step wizard to create an MyBusiness account. If you have any questions or would like help setting up your account please contact our office at 1-800-667-7153.

For existing businesses, please contact our office at 1-800-667-7153 to complete the set up process.

SPP & My Taxes

What is the difference between SPP and an RRSP?

SPP follows the same income tax deferral rules as an RRSP, but SPP is locked-in until age 55. Once you start collecting SPP annuities they are eligible for the Pension Income Tax Credit (you may be able to claim up to $2,000).

You record your SPP contribution tax receipts the same way you would record a regular RRSP contribution tax receipt. Under tax rules contributions to SPP can be used as repayments to the Home Buyers Plan (HBP) and the Lifelong Learning Plan (LLP) - However, withdrawals are not permitted for this purpose.

Who can use my SPP contribution for a tax deduction?

SPP contributions may be claimed by you or your spouse within CRA guidelines. The person using the contribution as a tax deduction must have available RRSP contribution room.

Check out this quick video about Tax deductibility of SPP.

When will I get my tax receipt?

Receipts for contributions made between March 1 and December 31 are issued in early January. Receipts for contributions made in the first 60 days of the year are issued mid-March.

Join SPP

Looking for more information about retirement savings?

Check out our under standing retirement savings playlist.

Is there a trial period in case my circumstances suddenly change?

Members may receive a refund of their account if they change their mind within 60 days of their date of application or their first contribution, whichever is later.

What information is needed to apply?

Personal contact details, name of a beneficiary, social insurance number, and proof of age documentation (e.g. photocopy of birth certificate, driver’s license, or passport).

When and how much can I contribute?

There is no set contribution schedule or minimum amount to invest, and now members can contribute any amount within their RRSP contribution room, subject to RRSP limits. You can also transfer in from existing unlocked RRSPs, RRIFs, RPPs, and DPSPs (funds locked in until age 55).